Advertisement

-

Published Date

March 14, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

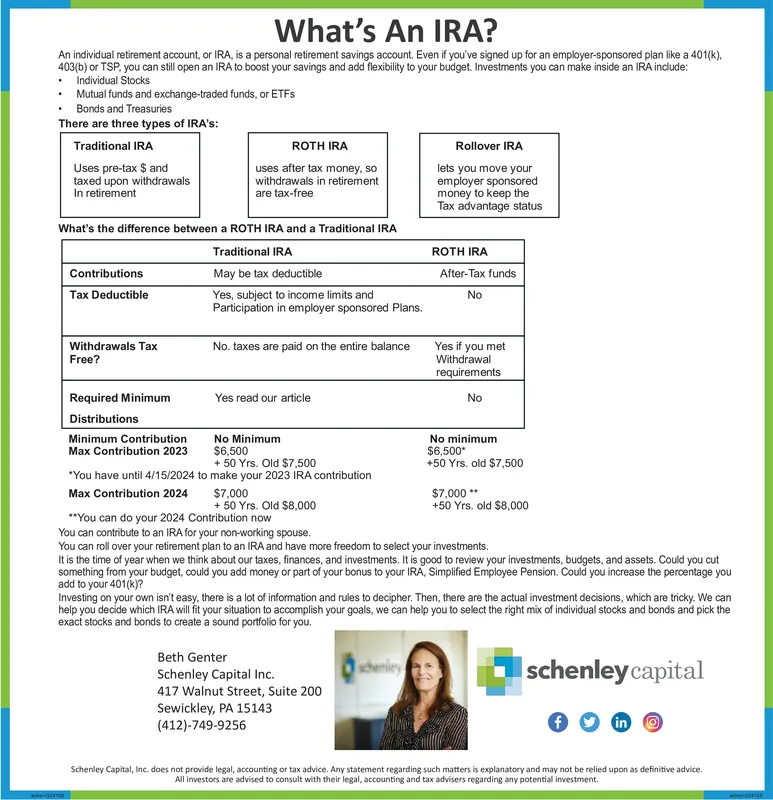

What's An IRA? An individual retirement account, or IRA, is a personal retirement savings account. Even if you've signed up for an employer-sponsored plan like a 401(k), 403(b) or TSP, you can still open an IRA to boost your savings and add flexibility to your budget. Investments you can make inside an IRA include: Individual Stocks Mutual funds and exchange-traded funds, or ETFs Bonds and Treasuries There are three types of IRA's: Traditional IRA Uses pre-tax $ and ROTH IRA uses after tax money, so withdrawals in retirement are tax-free Rollover IRA taxed upon withdrawals In retirement What's the difference between a ROTH IRA and a Traditional IRA Contributions Tax Deductible Withdrawals Tax Free? Traditional IRA May be tax deductible Yes, subject to income limits and Participation in employer sponsored Plans. No. taxes are paid on the entire balance Yes read our article lets you move your employer sponsored money to keep the Tax advantage status ROTH IRA After-Tax funds No Yes if you met Withdrawal requirements No Required Minimum Distributions Minimum Contribution Max Contribution 2023 *You have until 4/15/2024 to Max Contribution 2024 No Minimum $6,500 + 50 Yrs. Old $7,500 make your 2023 IRA contribution $7,000 + 50 Yrs. Old $8,000 **You can do your 2024 Contribution now You can contribute to an IRA for your non-working spouse. No minimum $6,500* +50 Yrs. old $7,500 $7,000 ** +50 Yrs. old $8,000 You can roll over your retirement plan to an IRA and have more freedom to select your investments. It is the time of year when we think about our taxes, finances, and investments. It is good to review your investments, budgets, and assets. Could you cut something from your budget, could you add money or part of your bonus to your IRA, Simplified Employee Pension. Could you increase the percentage you add to your 401(k)? Investing on your own isn't easy, there is a lot of information and rules to decipher. Then, there are the actual investment decisions, which are tricky. We can help you decide which IRA will fit your situation to accomplish your goals, we can help you to select the right mix of individual stocks and bonds and pick the exact stocks and bonds to create a sound portfolio for you. Beth Genter Schenley Capital Inc. 417 Walnut Street, Suite 200 Sewickley, PA 15143 (412)-749-9256 schenley schenley capital f in O Schenley Capital, Inc. does not provide legal, accounting or tax advice. Any statement regarding such matters is explanatory and may not be relied upon as definitive advice. All investors are advised to consult with their legal, accounting and tax advisers regarding any potential investment. What's An IRA ? An individual retirement account , or IRA , is a personal retirement savings account . Even if you've signed up for an employer - sponsored plan like a 401 ( k ) , 403 ( b ) or TSP , you can still open an IRA to boost your savings and add flexibility to your budget . Investments you can make inside an IRA include : Individual Stocks Mutual funds and exchange - traded funds , or ETFs Bonds and Treasuries There are three types of IRA's : Traditional IRA Uses pre - tax $ and ROTH IRA uses after tax money , so withdrawals in retirement are tax - free Rollover IRA taxed upon withdrawals In retirement What's the difference between a ROTH IRA and a Traditional IRA Contributions Tax Deductible Withdrawals Tax Free ? Traditional IRA May be tax deductible Yes , subject to income limits and Participation in employer sponsored Plans . No. taxes are paid on the entire balance Yes read our article lets you move your employer sponsored money to keep the Tax advantage status ROTH IRA After - Tax funds No Yes if you met Withdrawal requirements No Required Minimum Distributions Minimum Contribution Max Contribution 2023 * You have until 4/15/2024 to Max Contribution 2024 No Minimum $ 6,500 + 50 Yrs . Old $ 7,500 make your 2023 IRA contribution $ 7,000 + 50 Yrs . Old $ 8,000 ** You can do your 2024 Contribution now You can contribute to an IRA for your non - working spouse . No minimum $ 6,500 * +50 Yrs . old $ 7,500 $ 7,000 ** +50 Yrs . old $ 8,000 You can roll over your retirement plan to an IRA and have more freedom to select your investments . It is the time of year when we think about our taxes , finances , and investments . It is good to review your investments , budgets , and assets . Could you cut something from your budget , could you add money or part of your bonus to your IRA , Simplified Employee Pension . Could you increase the percentage you add to your 401 ( k ) ? Investing on your own isn't easy , there is a lot of information and rules to decipher . Then , there are the actual investment decisions , which are tricky . We can help you decide which IRA will fit your situation to accomplish your goals , we can help you to select the right mix of individual stocks and bonds and pick the exact stocks and bonds to create a sound portfolio for you . Beth Genter Schenley Capital Inc. 417 Walnut Street , Suite 200 Sewickley , PA 15143 ( 412 ) -749-9256 schenley schenley capital f in O Schenley Capital , Inc. does not provide legal , accounting or tax advice . Any statement regarding such matters is explanatory and may not be relied upon as definitive advice . All investors are advised to consult with their legal , accounting and tax advisers regarding any potential investment .