Advertisement

-

Published Date

June 15, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

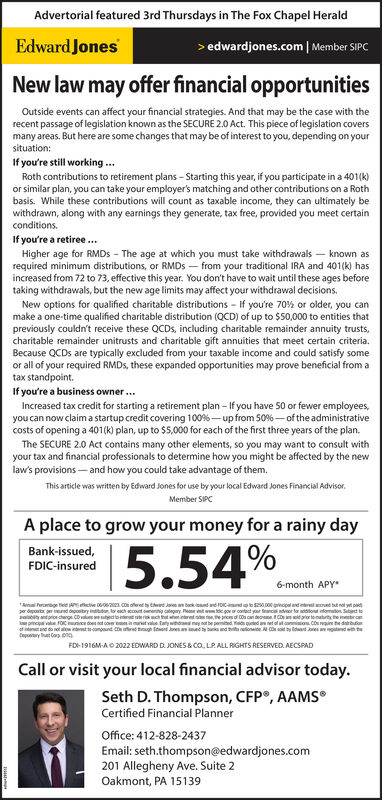

Advertorial featured 3rd Thursdays in The Fox Chapel Herald Edward Jones > edwardjones.com | Member SIPC New law may offer financial opportunities Outside events can affect your financial strategies. And that may be the case with the recent passage of legislation known as the SECURE 2.0 Act. This piece of legislation covers many areas. But here are some changes that may be of interest to you, depending on your situation: If you're still working ... Roth contributions to retirement plans - Starting this year, if you participate in a 401(k) or similar plan, you can take your employer's matching and other contributions on a Roth basis. While these contributions will count as taxable income, they can ultimately be withdrawn, along with any earnings they generate, tax free, provided you meet certain conditions. If you're a retiree ... Higher age for RMDS - The age at which you must take withdrawals - known as required minimum distributions, or RMDS from your traditional IRA and 401(k) has increased from 72 to 73, effective this year. You don't have to wait until these ages before taking withdrawals, but the new age limits may affect your withdrawal decisions. New options for qualified charitable distributions - If you're 70% or older, you can make a one-time qualified charitable distribution (QCD) of up to $50,000 to entities that previously couldn't receive these QCDs, including charitable remainder annuity trusts, charitable remainder unitrusts and charitable gift annuities that meet certain criteria. Because QCDs are typically excluded from your taxable income and could satisfy some or all of your required RMDs, these expanded opportunities may prove beneficial from a tax standpoint. If you're a business owner... Increased tax credit for starting a retirement plan - If you have 50 or fewer employees, you can now claim a startup credit covering 100%-up from 50%-of the administrative costs of opening a 401(k) plan, up to $5,000 for each of the first three years of the plan. The SECURE 2.0 Act contains many other elements, so you may want to consult with your tax and financial professionals to determine how you might be affected by the new law's provisions--and how you could take advantage of them. This article was written by Edward Jones for use by your local Edward Jones Financial Advisor. Member SIPC A place to grow your money for a rainy day Bank-issued, FDIC-insured 5.54% perdered and principal value FOC of and do not Dery Co effective 06-06/2003 CD offered by Edward Jonesa bokund try to each a indrets 6-month APY* up to $250,000 principal and interaccrued but not yet p financial advisor for addot information S do CDoanaeold girior to matrts the in are of a common Cathed by banks and thenede Al CDs sold by Edward Joh change CD values are set ince does not cover E into compound CDs offered through and Jones FDI-1916M-A2022 EDWARD D. JONES & CO, LP. ALL RIGHTS RESERVED. AECSPAD Call or visit your local financial advisor today. Seth D. Thompson, CFP®, AAMS® Certified Financial Planner Office: 412-828-2437 Email: seth.thompson@edwardjones.com 201 Allegheny Ave. Suite 2 Oakmont, PA 15139 Advertorial featured 3rd Thursdays in The Fox Chapel Herald Edward Jones > edwardjones.com | Member SIPC New law may offer financial opportunities Outside events can affect your financial strategies . And that may be the case with the recent passage of legislation known as the SECURE 2.0 Act . This piece of legislation covers many areas . But here are some changes that may be of interest to you , depending on your situation : If you're still working ... Roth contributions to retirement plans - Starting this year , if you participate in a 401 ( k ) or similar plan , you can take your employer's matching and other contributions on a Roth basis . While these contributions will count as taxable income , they can ultimately be withdrawn , along with any earnings they generate , tax free , provided you meet certain conditions . If you're a retiree ... Higher age for RMDS - The age at which you must take withdrawals - known as required minimum distributions , or RMDS from your traditional IRA and 401 ( k ) has increased from 72 to 73 , effective this year . You don't have to wait until these ages before taking withdrawals , but the new age limits may affect your withdrawal decisions . New options for qualified charitable distributions - If you're 70 % or older , you can make a one - time qualified charitable distribution ( QCD ) of up to $ 50,000 to entities that previously couldn't receive these QCDs , including charitable remainder annuity trusts , charitable remainder unitrusts and charitable gift annuities that meet certain criteria . Because QCDs are typically excluded from your taxable income and could satisfy some or all of your required RMDs , these expanded opportunities may prove beneficial from a tax standpoint . If you're a business owner ... Increased tax credit for starting a retirement plan - If you have 50 or fewer employees , you can now claim a startup credit covering 100 % -up from 50 % -of the administrative costs of opening a 401 ( k ) plan , up to $ 5,000 for each of the first three years of the plan . The SECURE 2.0 Act contains many other elements , so you may want to consult with your tax and financial professionals to determine how you might be affected by the new law's provisions -- and how you could take advantage of them . This article was written by Edward Jones for use by your local Edward Jones Financial Advisor . Member SIPC A place to grow your money for a rainy day Bank - issued , FDIC - insured 5.54 % perdered and principal value FOC of and do not Dery Co effective 06-06 / 2003 CD offered by Edward Jonesa bokund try to each a indrets 6 - month APY * up to $ 250,000 principal and interaccrued but not yet p financial advisor for addot information S do CDoanaeold girior to matrts the in are of a common Cathed by banks and thenede Al CDs sold by Edward Joh change CD values are set ince does not cover E into compound CDs offered through and Jones FDI - 1916M - A2022 EDWARD D. JONES & CO , LP . ALL RIGHTS RESERVED . AECSPAD Call or visit your local financial advisor today . Seth D. Thompson , CFP® , AAMS® Certified Financial Planner Office : 412-828-2437 Email : seth.thompson@edwardjones.com 201 Allegheny Ave. Suite 2 Oakmont , PA 15139