Advertisement

-

Published Date

November 30, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

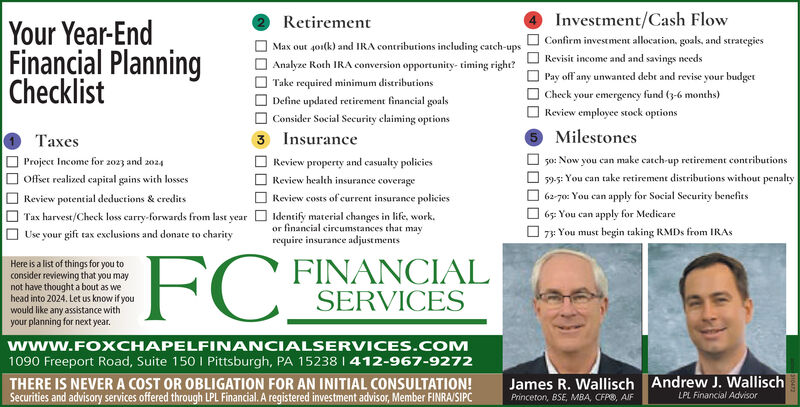

Your Year-End Financial Planning Checklist Taxes Project Income for 2023 and 2024 Offset realized capital gains with losses Review potential deductions & credits Tax harvest/Check loss carry-forwards from last year Use your gift tax exclusions and donate to charity Here is a list of things for you to consider reviewing that you may not have thought about as we head into 2024. Let us know if you would like any assistance with your planning for next year. 2 Retirement Max out 401(k) and IRA contributions including catch-ups Analyze Roth IRA conversion opportunity- timing right? Take required minimum distributions Define updated retirement financial goals Consider Social Security claiming options 3 Insurance Review property and casualty policies Review health insurance coverage Review costs of current insurance policies Identify material changes in life, work. or financial circumstances that may require insurance adjustments FC FINANCIAL SERVICES WWW.FOXCHAPELFINANCIALSERVICES.COM 1090 Freeport Road, Suite 150 I Pittsburgh, PA 15238 | 412-967-9272 THERE IS NEVER A COST OR OBLIGATION FOR AN INITIAL CONSULTATION! Securities and advisory services offered through LPL Financial. A registered investment advisor, Member FINRA/SIPC Investment/Cash Flow Confirm investment allocation, goals, and strategies Revisit income and and savings needs Pay off any unwanted debt and revise your budget Check your emergency fund (3-6 months) Review employee stock options Milestones 50: Now you can make catch-up retirement contributions 59-5: You can take retirement distributions without penalty 62-70: You can apply for Social Security benefits 65: You can apply for Medicare 73: You must begin taking RMDS from IRAS James R. Wallisch Andrew J. Wallisch LPL Financial Advisor Princeton, BSE, MBA, CFP®, AIF Your Year - End Financial Planning Checklist Taxes Project Income for 2023 and 2024 Offset realized capital gains with losses Review potential deductions & credits Tax harvest / Check loss carry - forwards from last year Use your gift tax exclusions and donate to charity Here is a list of things for you to consider reviewing that you may not have thought about as we head into 2024. Let us know if you would like any assistance with your planning for next year . 2 Retirement Max out 401 ( k ) and IRA contributions including catch - ups Analyze Roth IRA conversion opportunity- timing right ? Take required minimum distributions Define updated retirement financial goals Consider Social Security claiming options 3 Insurance Review property and casualty policies Review health insurance coverage Review costs of current insurance policies Identify material changes in life , work . or financial circumstances that may require insurance adjustments FC FINANCIAL SERVICES WWW.FOXCHAPELFINANCIALSERVICES.COM 1090 Freeport Road , Suite 150 I Pittsburgh , PA 15238 | 412-967-9272 THERE IS NEVER A COST OR OBLIGATION FOR AN INITIAL CONSULTATION ! Securities and advisory services offered through LPL Financial . A registered investment advisor , Member FINRA / SIPC Investment / Cash Flow Confirm investment allocation , goals , and strategies Revisit income and and savings needs Pay off any unwanted debt and revise your budget Check your emergency fund ( 3-6 months ) Review employee stock options Milestones 50 : Now you can make catch - up retirement contributions 59-5 : You can take retirement distributions without penalty 62-70 : You can apply for Social Security benefits 65 : You can apply for Medicare 73 : You must begin taking RMDS from IRAS James R. Wallisch Andrew J. Wallisch LPL Financial Advisor Princeton , BSE , MBA , CFP® , AIF