Advertisement

-

Published Date

March 21, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

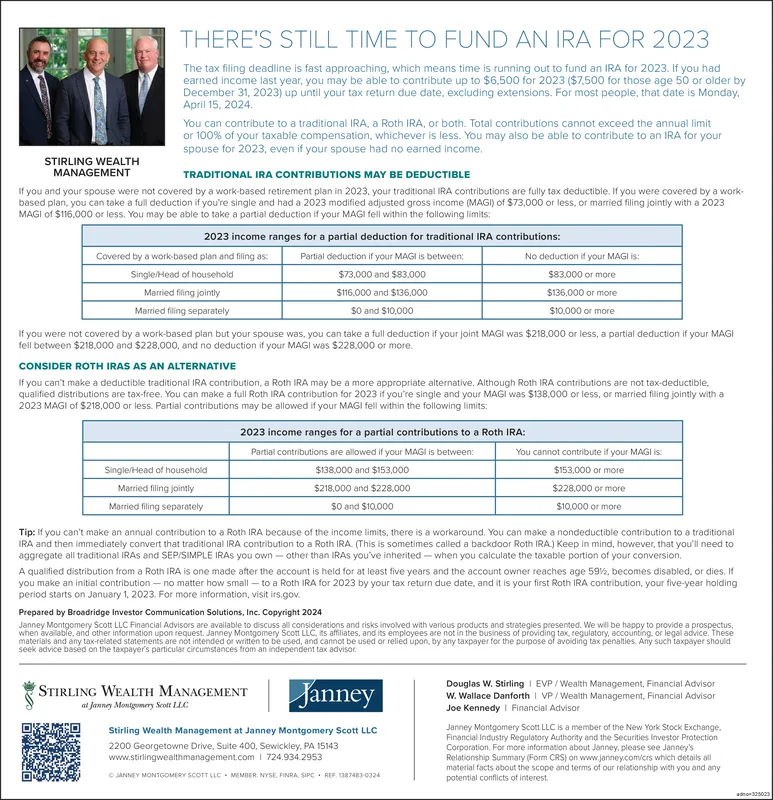

STIRLING WEALTH MANAGEMENT THERE'S STILL TIME TO FUND AN IRA FOR 2023 The tax filing deadline is fast approaching, which means time is running out to fund an IRA for 2023. If you had earned income last year, you may be able to contribute up to $6.500 for 2023 ($7.500 for those age 50 or older by December 31, 2023) up until your tax return due date, excluding extensions. For most people, that date is Monday, April 15, 2024. You can contribute to a traditional IRA, a Roth IRA, or both. Total contributions cannot exceed the annual limit or 100% of your taxable compensation, whichever is less. You may also be able to contribute to an IRA for your spouse for 2023, even if your spouse had no earned income. TRADITIONAL IRA CONTRIBUTIONS MAY BE DEDUCTIBLE If you and your spouse were not covered by a work-based retirement plan in 2023, your traditional IRA contributions are fully tax deductible. If you were covered by a work- based plan, you can take a full deduction if you're single and had a 2023 modified adjusted gross income (MAGI) of $73,000 or less, or married filing jointly with a 2023 MAGI of $116,000 or less. You may be able to take a partial deduction if your MAGI fell within the following limits: 2023 income ranges for a partial deduction for traditional IRA contributions: Covered by a work-based plan and filing as: Single/Head of household Married filing jointly Married filing separately Partial deduction if your MAGI is between: $73,000 and $83,000 $116,000 and $136,000 $0 and $10,000 No deduction if your MAGI is: $83,000 or more $136,000 or more $10,000 or more If you were not covered by a work-based plan but your spouse was, you can take a full deduction if your joint MAGI was $218,000 or less, a partial deduction if your MAGI fell between $218,000 and $228,000, and no deduction if your MAGI was $228,000 or more. CONSIDER ROTH IRAS AS AN ALTERNATIVE If you can't make a deductible traditional IRA contribution, a Roth IRA may be a more appropriate alternative. Although Roth IRA contributions are not tax-deductible. qualified distributions are tax-free. You can make a full Roth IRA contribution for 2023 if you're single and your MAGI was $138,000 or less, or married filing jointly with a 2023 MAGI of $218,000 or less. Partial contributions may be allowed if your MAGI fell within the following limits: Single/Head of household Married filing jointly Married filing separately 2023 income ranges for a partial contributions to a Roth IRA: Partial contributions are allowed if your MAGI is between: $138,000 and $153,000 $218,000 and $228,000 $0 and $10,000 You cannot contribute if your MAGI is: $153,000 or more $228,000 or more $10,000 or more Tip: If you can't make an annual contribution to a Roth IRA because of the income limits, there is a workaround. You can make a nondeductible contribution to a traditional IRA and then immediately convert that traditional IRA contribution to a Roth IRA. (This is sometimes called a backdoor Roth IRA) Keep in mind, however, that you'll need to aggregate all traditional IRAS and SEP/SIMPLE IRAS you own - other than IRAS you've inherited - when you calculate the taxable portion of your conversion. A qualified distribution from a Roth IRA is one made after the account is held for at least five years and the account owner reaches age 59%, becomes disabled, or dies. If you make an initial contribution - no matter how small- to a Roth IRA for 2023 by your tax return due date, and it is your first Roth IRA contribution, your five-year holding period starts on January 1, 2023. For more information, visit irs.gov. Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2024 Janney Montgomery Scott LLC Financial Advisors are available to discuss all considerations and risks involved with various products and strategies presented. We will be happy to provide a prospectus, when available, and other information upon request. Janney Montgomery Scott LLC, its affiliates, and its employees are not in the business of providing tax, regulatory, accounting, or legal advice. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor. STIRLING WEALTH MANAGEMENT at Janney Montgomery Scott LLC Janney Stirling Wealth Management at Janney Montgomery Scott LLC 2200 Georgetowne Drive, Suite 400, Sewickley, PA 15143 www.stirlingwealthmanagement.com | 724.934.2953 © JANNEY MONTGOMERY SCOTT LLC MEMBER: NYSE, FINRA, SIPC REF. 1387483-0324 Douglas W. Stirling | EVP/Wealth Management, Financial Advisor W. Wallace Danforth | VP/Wealth Management, Financial Advisor Joe Kennedy | Financial Advisor Janney Montgomery Scott LLC is a member of the New York Stock Exchange. Financial Industry Regulatory Authority and the Securities Investor Protection Corporation. For more information about Janney, please see Janney's Relationship Summary (Form CRS) on www.janney.com/crs which details all material facts about the scope and terms of our relationship with you and any potential conflicts of interest adno-325023 STIRLING WEALTH MANAGEMENT THERE'S STILL TIME TO FUND AN IRA FOR 2023 The tax filing deadline is fast approaching , which means time is running out to fund an IRA for 2023. If you had earned income last year , you may be able to contribute up to $ 6.500 for 2023 ( $ 7.500 for those age 50 or older by December 31 , 2023 ) up until your tax return due date , excluding extensions . For most people , that date is Monday , April 15 , 2024 . You can contribute to a traditional IRA , a Roth IRA , or both . Total contributions cannot exceed the annual limit or 100 % of your taxable compensation , whichever is less . You may also be able to contribute to an IRA for your spouse for 2023 , even if your spouse had no earned income . TRADITIONAL IRA CONTRIBUTIONS MAY BE DEDUCTIBLE If you and your spouse were not covered by a work - based retirement plan in 2023 , your traditional IRA contributions are fully tax deductible . If you were covered by a work- based plan , you can take a full deduction if you're single and had a 2023 modified adjusted gross income ( MAGI ) of $ 73,000 or less , or married filing jointly with a 2023 MAGI of $ 116,000 or less . You may be able to take a partial deduction if your MAGI fell within the following limits : 2023 income ranges for a partial deduction for traditional IRA contributions : Covered by a work - based plan and filing as : Single / Head of household Married filing jointly Married filing separately Partial deduction if your MAGI is between : $ 73,000 and $ 83,000 $ 116,000 and $ 136,000 $ 0 and $ 10,000 No deduction if your MAGI is : $ 83,000 or more $ 136,000 or more $ 10,000 or more If you were not covered by a work - based plan but your spouse was , you can take a full deduction if your joint MAGI was $ 218,000 or less , a partial deduction if your MAGI fell between $ 218,000 and $ 228,000 , and no deduction if your MAGI was $ 228,000 or more . CONSIDER ROTH IRAS AS AN ALTERNATIVE If you can't make a deductible traditional IRA contribution , a Roth IRA may be a more appropriate alternative . Although Roth IRA contributions are not tax - deductible . qualified distributions are tax - free . You can make a full Roth IRA contribution for 2023 if you're single and your MAGI was $ 138,000 or less , or married filing jointly with a 2023 MAGI of $ 218,000 or less . Partial contributions may be allowed if your MAGI fell within the following limits : Single / Head of household Married filing jointly Married filing separately 2023 income ranges for a partial contributions to a Roth IRA : Partial contributions are allowed if your MAGI is between : $ 138,000 and $ 153,000 $ 218,000 and $ 228,000 $ 0 and $ 10,000 You cannot contribute if your MAGI is : $ 153,000 or more $ 228,000 or more $ 10,000 or more Tip : If you can't make an annual contribution to a Roth IRA because of the income limits , there is a workaround . You can make a nondeductible contribution to a traditional IRA and then immediately convert that traditional IRA contribution to a Roth IRA . ( This is sometimes called a backdoor Roth IRA ) Keep in mind , however , that you'll need to aggregate all traditional IRAS and SEP / SIMPLE IRAS you own - other than IRAS you've inherited - when you calculate the taxable portion of your conversion . A qualified distribution from a Roth IRA is one made after the account is held for at least five years and the account owner reaches age 59 % , becomes disabled , or dies . If you make an initial contribution - no matter how small- to a Roth IRA for 2023 by your tax return due date , and it is your first Roth IRA contribution , your five - year holding period starts on January 1 , 2023. For more information , visit irs.gov . Prepared by Broadridge Investor Communication Solutions , Inc. Copyright 2024 Janney Montgomery Scott LLC Financial Advisors are available to discuss all considerations and risks involved with various products and strategies presented . We will be happy to provide a prospectus , when available , and other information upon request . Janney Montgomery Scott LLC , its affiliates , and its employees are not in the business of providing tax , regulatory , accounting , or legal advice . These materials and any tax - related statements are not intended or written to be used , and cannot be used or relied upon , by any taxpayer for the purpose of avoiding tax penalties . Any such taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor . STIRLING WEALTH MANAGEMENT at Janney Montgomery Scott LLC Janney Stirling Wealth Management at Janney Montgomery Scott LLC 2200 Georgetowne Drive , Suite 400 , Sewickley , PA 15143 www.stirlingwealthmanagement.com | 724.934.2953 © JANNEY MONTGOMERY SCOTT LLC MEMBER : NYSE , FINRA , SIPC REF . 1387483-0324 Douglas W. Stirling | EVP / Wealth Management , Financial Advisor W. Wallace Danforth | VP / Wealth Management , Financial Advisor Joe Kennedy | Financial Advisor Janney Montgomery Scott LLC is a member of the New York Stock Exchange . Financial Industry Regulatory Authority and the Securities Investor Protection Corporation . For more information about Janney , please see Janney's Relationship Summary ( Form CRS ) on www.janney.com/crs which details all material facts about the scope and terms of our relationship with you and any potential conflicts of interest adno - 325023